No matter which way you look at, content will continue to be a significant component of the digital marketing strategy of automotive brands for the foreseeable future. Whether it be through press engagements, native advertising or sponsored articles, the ability to create stories and emotive themes around a particular brand will be paramount in helping car companies to be relatable to specific lifestyle trends and demographics.

While traditional web banner advertising and keyword selection continue to be relevant, native advertising offers marketers a more creative outlet to express more information about brands without the restrictions of the character limits beholden to traditional web advertising. As such, it’s hardly surprising that the marketers have been gun-ho about content marketing throughout the recent years.

Locally, sponsored stories together with social influencer marketing is predicted to be one of the major trends that will shape digital marketing in 2018. This in part is due to the Filipino’s being among some of the world’s most trusting and accepting populations of brands on social media, according to a published Kantar TNS study.

The local automotive scene is not short of a solid content backbone. Editorial reviews, sponsored stories and regular press releases are commonplace on any automotive website. This content remains prominent (and essential) due to the significant degree of research that needs to be done ahead of purchasing a vehicle. As such automakers have a lot of opportunity to capture the attention of buyers and sell products through a variety of different content executions.

With that said, what the marketers are dying to know (and measure nowadays) is the importance of content in the cycle of making a purchase. Given the rising demand of ROI-driven online marketing, many marketers are now looking to dig deeper than page views to uncover data related to real-world transactions. As such, AutoDeal.com.ph took a look at some data and asked ourselves: How relevant is content to lead-generation? Do they go hand-in-hand? And if so, how can automotive brands truly measure the ROI of sponsored content from offline transactions?

Here’s what we discovered.

5% of people who read reviews directly move on to lead-generating pages.

While reviews remain popular, according to AutoDeal data, 5% of those people that read reviews will immediately click through to a lead-generating page in the same session. Quite simply put, it’s probable that the consumption of review content and the intent-to-buy mindset do not always overlap simultaneously. With that said a 5% clickthrough rate is nothing to be shunned given the hundreds of thousands of monthly page views on review sites, and it’s still much higher than the industry standard clickthrough on a display banner ad.

Organic is still king of automotive sales. Consider the long-term.

When it comes to native-advertising, social media sites like Facebook and Twitter reign supreme in terms of market dominance and basic delivery metrics like clickthroughs and impressions. With that said, marketers and media agencies should remain vigilant about the long-term relevance of their content as organic traffic is proven to be the highest contributor to sales volume and conversion according to data driven from AutoDeal’s lead-reconnaissance features.

In summary, sales from users acquired through organic search contributed to 73.7% of annual sales reported for dealers on the AutoDeal platform in 2017. With that said, marketers need to employ the proper tools to measure the long term effects of their content, not only basic metrics like page views but depth metrics like leads and sales.

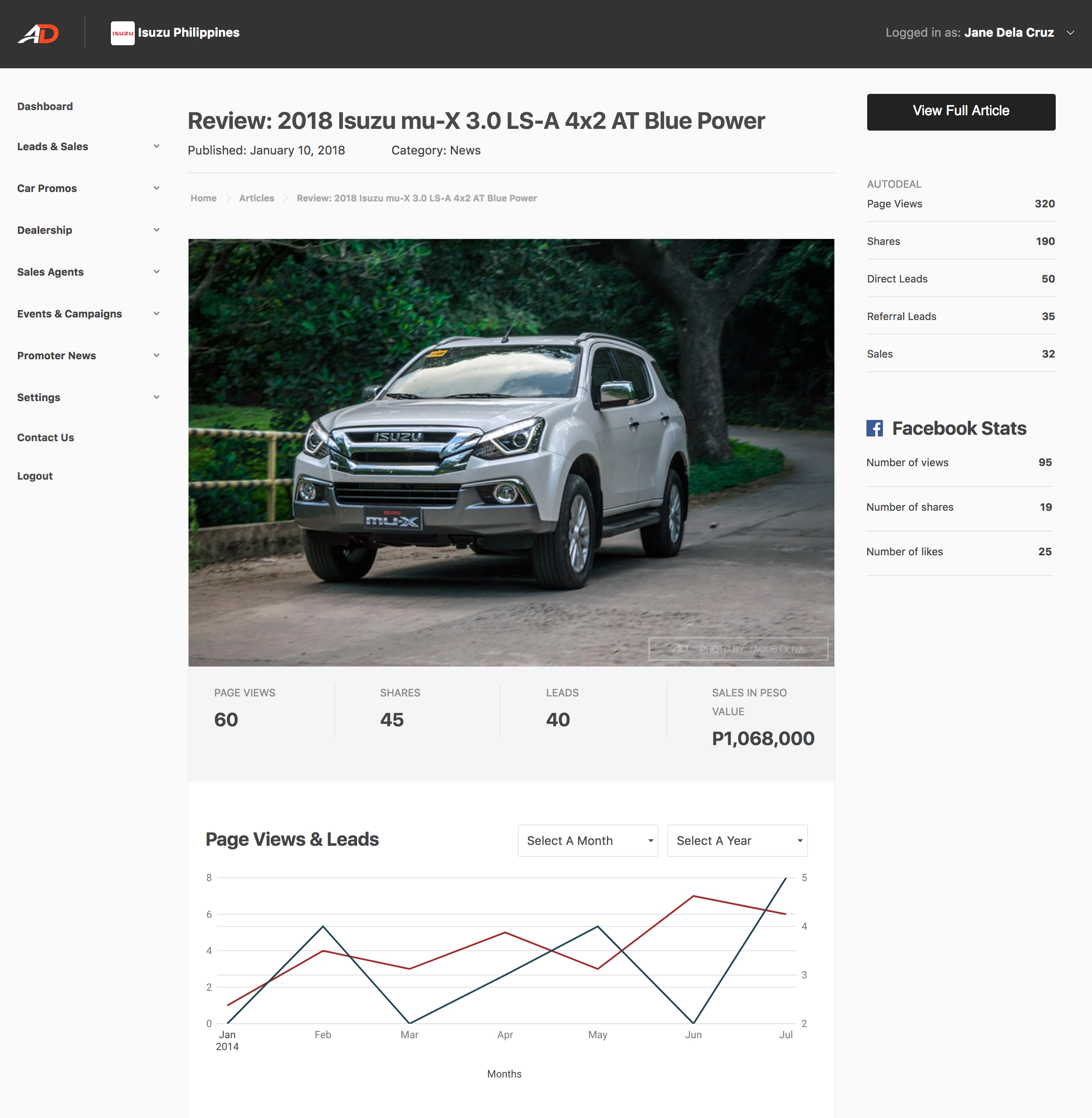

Tools like AutoDeal’s new content-analysis plug-in will now provide marketers with the ability to constantly measure the impact of their articles over time as a means to show the exponential return-on-investment for brands over extended periods of time.

Users who read reviews, return.

According to AutoDeal’s Google Analytics data, around 60% of people who read car reviews will return to read more car reviews over a six-month period. This massively extends past the typical 45-day lead-to-sale conversion timeline that we experience from users who purchase across the AutoDeal platform. As a result this data suggests one of two possible scenarios:

- A lot of people just like to read car reviews - and as such they’re not that significantly tied to the car-buying process.

- Car buyers read reviews very early on in the buying process.

If the latter be true not only for reviews but for other forms of content, then it would seem somewhat apparent that content may serve as one of the best means to expand the width of an automakers lead funnel. As such, understanding how different audiences engage with specific types of content is vital in helping marketers to understand how valuable content is in driving lead and sales generation further down their pipeline.

As such, content remains significant as an initial pre-cursor to lead-generation; provided that you’re able to critically assess it as such.