Securing a financing deal that’s worth your time and money can be quite tough. The luxury of choice when it comes to financing providers may not always be afforded by all, and the ability to cross-check several quotes at once is also a challenge for a lot of consumers.

At AutoDeal, we hope to keep streamlining and simplifying the car-buying experience. The process of buying your car shouldn’t be marred by several trips to multiple dealers to get the best deal, hunt for the most worthwhile promos, and get an idea about how a car performs. Currently, our platform supports the research and quotation part of the car-buying process, but we’re making the financing process much easier and quite a bit friendlier for everyone, specifically for promos and through dealer financing.

What is AutoDeal Car Loan?

There are two main types of car buyers when it comes to sealing a deal, ones that prefer to pay in cash, and others that prefer to finance a deal over a period of time. Financing is one of the most common ways that people can afford the car of their choice, and it’s a system that can potentially get quite expensive over time depending on the deal you get.

So after shopping for your car, and if you’re looking to finance it over a period of time, after locking in a deal or a unit, securing a financing deal is the next step. Choosing a car is pretty easy as you can let your heart decide, but securing the financing deal is another process, and that’s where AutoDeal Car Loan comes in. Just like how AutoDeal streamlines the process of researching, comparing, then connecting with your preferred dealer, Car Loan helps the car-buying process of financing with our dealer partners. Our feature makes it even easier to get the best deal for any car on promo from any of our Partner Dealers advertised on the promos page or otherwise.

Get the best deal and get an estimate of your monthly amortization rates quickly based on the price of the car and how much you’re planning to put down for the initial payment. You will get a quote after your application within 48 hours (two days).

Where to start?

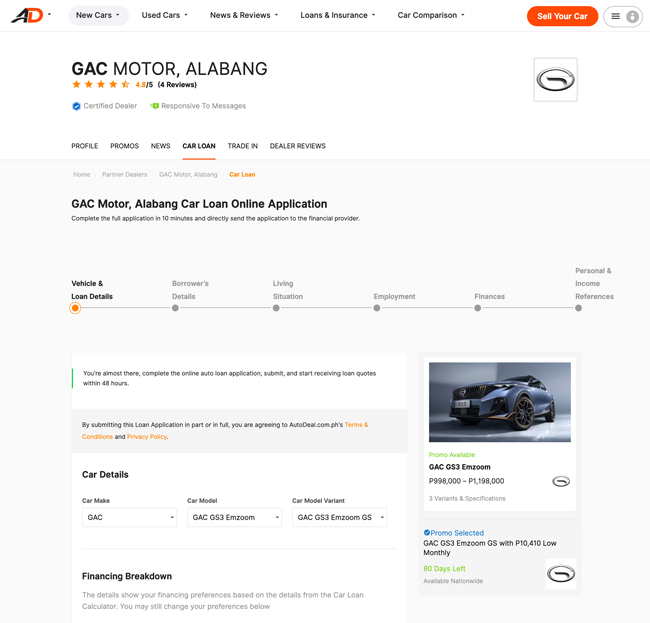

There are two ways to access this feature. The first is to head on over to your preferred dealer’s page. Check with our list of AutoDeal Dealers to see if there is a partner near you. Next is to look for “Car Loan” in the horizontal navigation tab and click on through.

The other way is to go through any one of our promo pages. Find a promo that you like first, then look for the Car Loan section by scrolling down.

In both instances look for the “Start Now” button in order to get your application process underway.

Pro-tip, make sure to apply for an AutoDeal account with us so that a good chunk of your personal information will be saved and accessible later on. You may still apply for a loan without an AutoDeal account, however, but apply for an account to save all your info, quotes, and messages at login. On top of having a convenient account to bank all your application data and inquiries in, you’re also assured of data security, making things much easier and much safer to transact—all at the same time.

What are the requirements for the AutoDeal Car Loan Application?

As part of the background check, the application process will require you to submit a few bits of information, on top of your eligibility as a Car Loan applicant.

Minimum requirements

- Total income must be equal to or above Php 40,000 per month (Our form takes care of the circumstance differences)

- Two (2) years minimum employment tenure.

- Minimum age must be 21 years or above.

- Primary Borrower

- 1 primary government ID or 2 other IDs.

- Mortgaged or rented property info.

- Employment or business documentation.

- Co-Maker

- One (1) primary government ID or two (2) other IDs.

- Mortgaged or rented property info.

- Employment or business documentation.

- Must be a Filipino citizen residing in the Philippines.

- Maximum age of 65 years old.

Pick any dealer and any promo

For any car promo available on AutoDeal, you can get an instant estimate for your monthly amortization based on the downpayment that you plan to make and the model that you plan to buy. Following that, you will be asked what your initial downpayment amount will be as well as your loan term.

For your loan term, you can select between 12 months to 60 months (one year to five years) to serve as your term. Next, you will be indicating your initial downpayment amount on the form. Once both fields are filled out, you will receive a rough estimate of your financing deal. Note, however, that this is not the final amount and can still be subject to change depending on our financing partners’ assessment of your application.

Submit your requirements—securely

Following that, you will need to enter your personal information on the page to proceed through the next steps. These include Borrower’s Details, Living Situation, Employment, Finances, and Personal Income and references.

Each step of the application process will be important in getting an accurate quote for your deal so bear with us. Follow the instructions, and be assured that your information will be handed to involved and trusted parties from any one of our Dealer Partners.

Receiving your quote

After you’ve gone through the application process, inputted your information, and hit send on all the pages, you will receive an email or a notification on your AutoDeal account within the next 48 hours (two days) of clicking through all the application pages.

After receiving your financing quote, it’ll be as simple as presenting the information to your AutoDeal agent and proceeding with the rest of the deal. Then, of course, it’s driving off with your brand-new car.

Latest Features

-

The difference between wax and polish / Tips & Advice

Confused about whether your car needs a wax or polish? This article will guide you on what they are and what to choose for your car.

-

The 6 things every Ford Ranger must pass before it leaves the factory / Featured Article

Every Ford Ranger, from the base model to the Ranger Raptor, goes through a full inspection process before it leaves the factory. This includes six steps that make sure it’s ready to drive a...

-

Which GAC AION EV is best for your everyday lifestyle? / Featured Article

The GAC AION lineup has something for everyone, maybe you're after space, speed, or just a smooth city drive. Here's a quick breakdown of which model might work best for your day-to-day life...

Popular Articles

-

Cheapest cars under P700,000 in the Philippines

Jerome Tresvalles · Sep 02, 2024

-

First car or next car, the Ford EcoSport is a tough package to beat

Jun 18, 2021

-

Car Maintenance checklist and guide – here’s everything you need to know

Earl Lee · Jan 12, 2021

-

Most fuel efficient family cars in the Philippines

Bryan Aaron Rivera · Nov 27, 2020

-

2021 Geely Okavango — Everything you need to know

Joey Deriquito · Nov 19, 2020

-

Family cars in the Philippines with the biggest trunks

Sep 20, 2023

-

Head to head: Toyota Rush vs. Suzuki XL7

Joey Deriquito · Oct 28, 2020

-

Why oil changes are important for your car

Earl Lee · Nov 10, 2020

-

2021 Kia Stonic — What you need to know about it

Joey Deriquito · Oct 16, 2020

-

Top 7 tips for buying a used car in the Philippines

Joey Deriquito · Nov 26, 2020