Several industries are turning to digital mediums as a means to reach consumers faster, provide a more convenient experience, and create less waste, especially paper. Traditionally, insurance policies are put to paper and ink. Consumers would also need to visit or call several providers in order to canvas their options to get the best deals.

Procuring insurance in the digital age is now different. The internet has made the one arduous task of going to different insurance providers more convenient. In general, finding insurance should be an easy process with all the options laid out for you. AutoDeal now provides a convenient solution for consumers to research, set up, and purchase their online insurance policies through our online insurance calculator, which lets you view the best deals and setup for your vehicle. Getting insured online isn't just more convenient, it is faster and less wasteful, allow us to explain.

Research and Payment

When shopping, it is healthy to have a wealth of options at the ready for you to compare. Getting the best value for money should also be a high priority, as it could save you P10,000. Just like shopping for a car, an insurance policy can get quite complex because there can be multiple features and nuances that accompany these products. Comparing other policies is also easier online, as information can be displayed on a single page for you to see. The features of an insurance policy may also differ from one company to the next. Instead of visiting and making several calls or finding an agent, finding the best deal can be easily done from the comfort of your home.

Finding the cost of your car's insurance policy will also be easier with the right resources. For example, a Toyota Fortuner might not have the same rates as another competing model. These bits of information can also factor into your purchasing decision, as insurance is another item to worry about on top of maintenance and running costs. Having all these options and the information displayed as a quote and will show an estimation of what you can expect to pay, which takes much of the guesswork out of your purchase.

Cashless transactions are quickly becoming the norm. With any credit card, debit card, Paypal Gcash or PayMaya, paying for products or services has become very easy and accessible at a moment’s notice. You don’t have to resort to physical forms of cash anymore, instead, you can opt for a secure and convenient method of payment. It will also be possible to spread the insurance cost over the period of a year through an installment payment plan.

E-policies

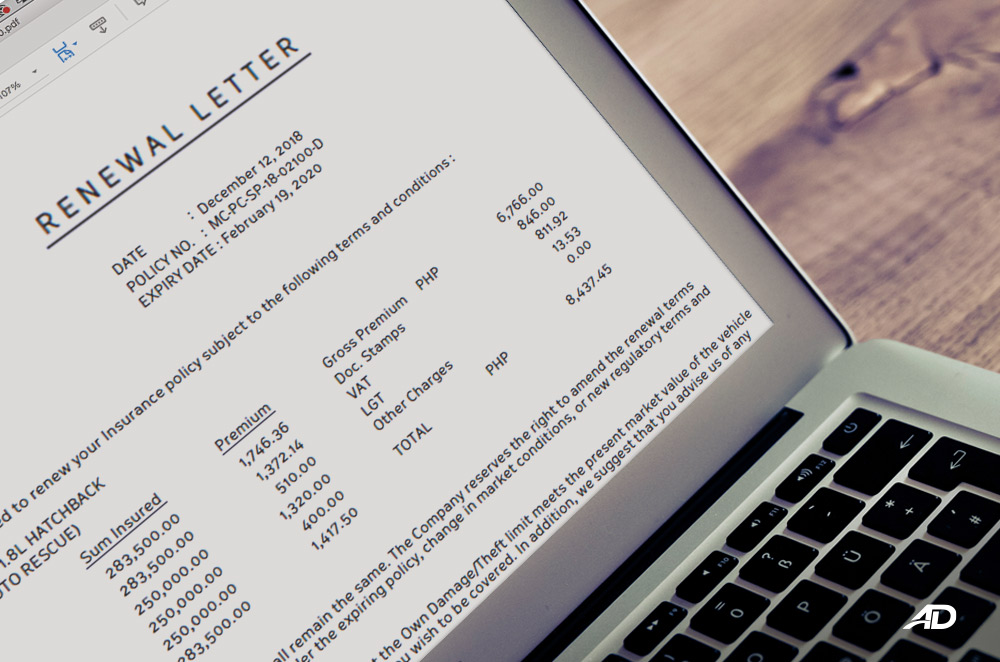

After transacting with the insurance provider, an electronic copy of your policy will be made available to you. This file is easily saved on your smartphone or computer and can be easily accessed and printed on your own at your own leisure. Policies that are put to paper have the tendency to get lost. The insurance provider will have to send you a new policy if this happens, however, if you do end up losing an e-policy, then all you would have to do is email your insurance provider for another copy to be sent to you.

There is also a speed advantage when dealing with electronic files since using a postal or delivery service will take a day to a week. Shooting an email can be done in a matter of seconds, which is faster and less labor-intensive. You also don’t have to sift through physical files, instead, the policy can be safely stored on your phone for easy access and convenience.

Also, when making a claim, you don’t need to bring a physical copy. In some instances, you wouldn’t need to hand off a piece of paper. Instead, the policy may be electronically sent to you, and other parties for filing or other reasons.

Processing and renewal

It is hard to beat digital files when it comes to processing speed as well. Application for a new policy can be done much quicker than mailing a written application and going through the processes manually. The same can be said for changes, as insurance providers can receive an email, make the necessary edits, process, and send a revised policy without waiting for logistics to catch up.

Renewal is also a cinch. There are even added features that can be implemented to the buying and renewal process for car insurance. For example, AutoDeal Insurance has a feature in place that will remind you when your policy is due for renewal, and a user-friendly interface, which provides multiple transparent insurance quotes from our partner providers, which you can choose from, taking the hassle out of your transaction.

Latest Features

-

The 6 things every Ford Ranger must pass before it leaves the factory / Featured Article

Every Ford Ranger, from the base model to the Ranger Raptor, goes through a full inspection process before it leaves the factory. This includes six steps that make sure it’s ready to drive a...

-

Which GAC AION EV is best for your everyday lifestyle? / Featured Article

The GAC AION lineup has something for everyone, maybe you're after space, speed, or just a smooth city drive. Here's a quick breakdown of which model might work best for your day-to-day life...

-

The AutoDeal Awards 2024: Celebrating excellence in the auto Industry / Featured Article

The AutoDeal Awards 2024: Celebrating excellence in the auto Industry

Popular Articles

-

Cheapest cars under P700,000 in the Philippines

Jerome Tresvalles · Sep 02, 2024

-

First car or next car, the Ford EcoSport is a tough package to beat

Jun 18, 2021

-

Car Maintenance checklist and guide – here’s everything you need to know

Earl Lee · Jan 12, 2021

-

Most fuel efficient family cars in the Philippines

Bryan Aaron Rivera · Nov 27, 2020

-

2021 Geely Okavango — Everything you need to know

Joey Deriquito · Nov 19, 2020

-

Family cars in the Philippines with the biggest trunks

Sep 20, 2023

-

Head to head: Toyota Rush vs. Suzuki XL7

Joey Deriquito · Oct 28, 2020

-

Why oil changes are important for your car

Earl Lee · Nov 10, 2020

-

2021 Kia Stonic — What you need to know about it

Joey Deriquito · Oct 16, 2020

-

Top 7 tips for buying a used car in the Philippines

Joey Deriquito · Nov 26, 2020