At AutoDeal, we consider ourselves to be a bit of an authority when it comes to evaluating online customer behavior and detecting market trends. As the number of prospective customers who visit AutoDeal continues to grow, so to does our endless depository of data.

In this, the first of a regular new series of posts, we will begin to open up the lid on a variety of different data sources to not only help indicate the overall performance of the industry but to showcase those brands and vehicles that are truly getting some remarkable results.

In an attempt to be somewhat scientific about what we do, we created what we now refer to as the AutoDeal Car Buying Search Index, and aptly awarded it with an incredibly memorable acronym - ADCBSI (Add-ce-be-si). The Search Index takes into consideration organic searches made on AutoDeal and aims to not only provide a reference point for national consumer interest levels but to also highlight those vehicles that are currently trending on the AutoDeal platform.

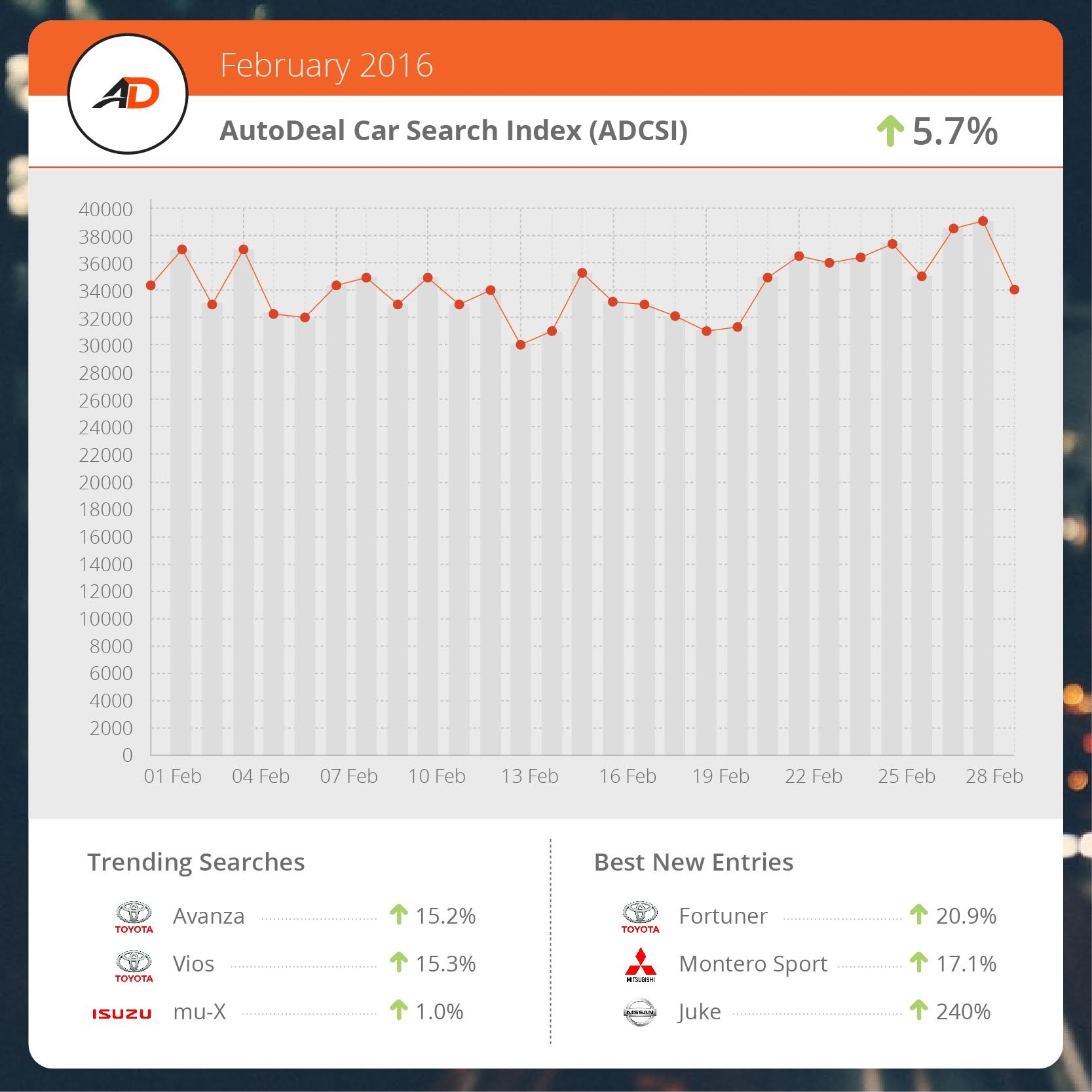

As we can see in February 2016, the Index itself is up 5.7%, showing an increase in customer browsing on AutoDeal. In addition to this, the levels of engagement on AutoDeal were also up by 50% resulting in a mich higher volume of lead-generation across the country. It will be interesting to see how these increases in customer interest and engagement materialize by the time that first quarter sales are announced.

Trending in February

The top trending vehicle continues to be the recently refreshed Toyota Avanza which showcased further interest growth of 15.2%. The Avanza also just happened to nudge ahead of the Philippines no.1 nameplate, the Toyota Vios that despite having 15.3% continued interest growth fell just short of it’s AUV sibling in total search volume. Third place was taken by the dark-horse of the mid-size SUV segment, the Isuzu mu-X which continues to maintain a strong presence on AutoDeal despite being overlooked in some of the press surrounding the media dubbed 'SUV Wars'. Based on our data, neither Ford, Mitsubishi or Toyota can afford to overlook Isuzu's contender in this segment battle.

Other vehicles that deserve mentioning (that are not represented in the graphic above) would be (yes you guessed it) a plethora of Toyota and Mitsubishi vehicles, including the Mitsubishi Adventure, Mitsubishi Mirage G-4, Toyota Innova, Toyota Wigo, Toyota Hiace and Toyota Hilux. Outside of the two biggest market-share holders, vehicles like All-New Ford Everest (up 17.8%), the Honda City (up 15.3%) and Nissan NP350 Urvan (up 29.4%) make noteworthy appearances in the top 20 list.

Lower down the pile in terms of volume, but still equally impressive in growth is the Mazda 2 Sedan (up 18.5%), the Suzuki Ertiga (up 41.3%) and the Honda Mobilio (up 33%).

Hot New Comers

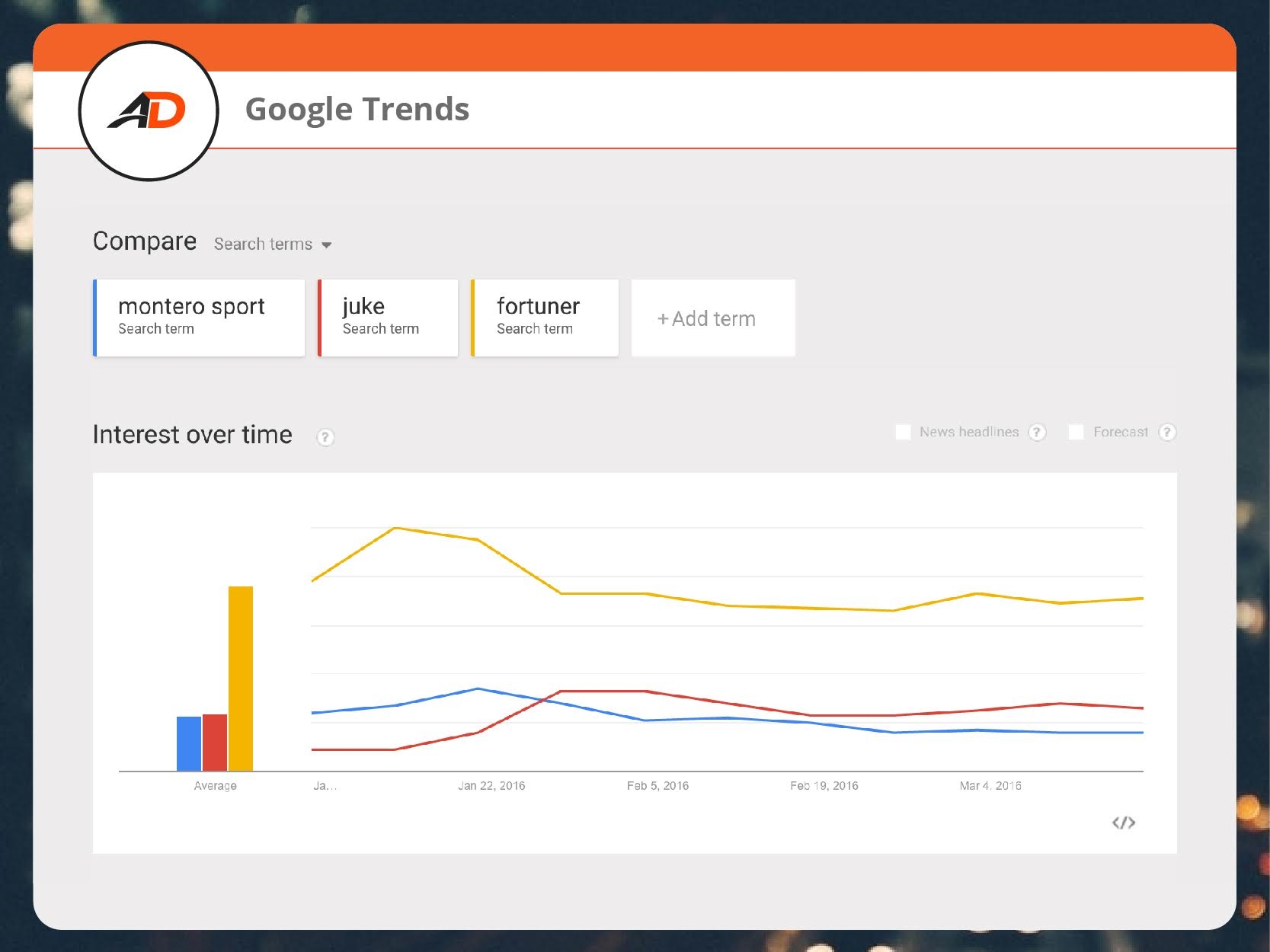

When looking at the recently-launched or upcoming pre-order interest levels, the elephant in the room for February is the Nissan Juke that ranked in third in the new vehicles category with a staggering 240.1% organic growth. Someone at Nissan Philippines Inc. is certainly deserving of a pat on the back as the Juke’s tagline of being “Built to Stand Out” is certainly true to form. In fact, we got so overly obsessed with the Juke’s metrics that we checked out Google Trends to see what their data had to say about it, and (based on the screenshot below), they corroborated our findings.

Despite a mainstream media smear campaign on the old model back in December 2015, the All-New Mitsubishi Montero Sport finished in second place (up 17.1%) ranking behind the huge pre-order interest in the All-New Toyota Fortuner, that had a further 20.9% increase in searches for February.

Of the three leaders in the new vehicle category, Google Trends also tells us it’s own story about a certain quirky looking compact crossover that seems to be getting more interest than a certain popular mid-size SUV.

Interested in looking at some more interesting trends? Check out the links below to review data on some of the hottest competition in the market right now courtesy of the good people at Google. Want to find out more about what's hot on AutoDeal? Keep an eye out for our upcoming Q1 2016 Industry Insights Report.